3 Insights to Increase App Installs for Fintech Marketers

From making payments to banking, mobile apps are changing the way consumers think about and manage their finances. According to Adjust’s Mobile App Trends 2022 report, global fintech app installs increased by 34% from 2020 to 2021, signifying a massive shift to mobile in the realm of personal finance.

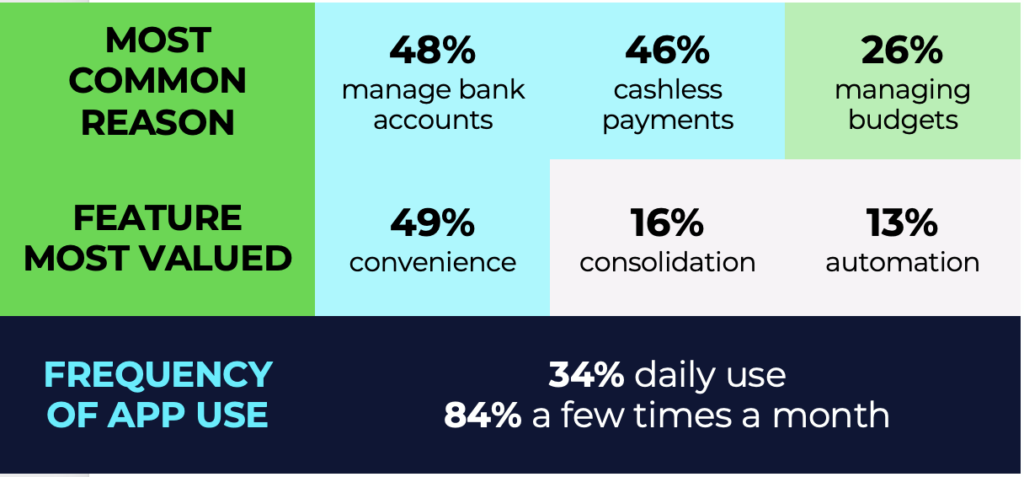

To understand consumers’ preferences and use cases, we surveyed* nearly 23K US adults to uncover which types of fintech apps they use most often and why. The results revealed:

Fast Facts for Fintech Marketers

Below we take a closer look at fintech trends across age, gender, and other demographics to help marketers better engage their ideal users and drive fintech app installs.

1. Rewards, tips and tools, and budgeting score biggest with Gen Z.

With a keen focus on financial literacy and independence, Gen Z is 50% more likely than other generations to cite getting tips and tools to meet their goals as the primary reason for using a finance app. They are also 43% more likely to use a finance app to manage their budget, outweighing making investments by 43%, and buying cryptocurrency by 136%. As a budget-conscious cohort that values a good deal, Gen Z also mirrors The Silent Generation as the second most likely to use a finance app to access rewards or incentives.

2. Genders differ on day-to-day vs. long-term tasks performed on finance apps.

While women are 11% more likely than men to use finance apps to complete everyday tasks like managing their bank account or making cashless payments, men turn to fintech for long-term planning; they are 50% more likely to use apps to make investments, and 46% more likely to use them to buy cryptocurrency. Despite varying use cases, frequency is consistent across genders, with 21% of both males and females using finance apps every day.

3. Reasons for using finance apps align with personal needs and life stage.

Life stage and household dynamics also influence consumers’ fintech usage. For example, when it comes to applying for credit loans, Baby Boomers are 38% more likely than other generations to use finance apps for this purpose – while renters are 19% more likely than homeowners to apply. Expectant parents cite managing budgets and making investments as a top use case, while on the other hand, those without children primarily use apps for cashless payments and banking.

Beyond the Basics: Finding the Right Users for Your Fintech App Offering

Finances are highly personal, and your user acquisition strategy should be too. To build trust, craft hyper-relevant content and messaging that speaks directly to consumers’ needs as they navigate key life events. Below, learn how two fintech companies drove success with custom content placements on The Smart Wallet (TSW) — Fluent’s proprietary media brand dedicated to helping consumers earn, win, and save money.

- Credit Sesame, a free credit monitoring service, partnered with TSW to provide future renters and homeowners with tips for improving their credit score – ultimately increasing customer sign-ups by over 20%.

- Truebill, a leading personal finance app, partnered with TSW to educate consumers on negotiating bills and optimizing spending, driving a nearly 60% lift in revenue per impression.

Ready to Grow Your Fintech App with Fluent?

As a fintech marketer, it’s important to look beyond demographic attributes like age and gender to gain a more holistic understanding of your target audience and drive stronger engagement. With access to 11 million monthly active users across our proprietary mobile experiences, we enable some of the largest fintech brands in the world to target and engage the best users for their apps. If driving mobile app installs for your business sounds good to you – connect with us here.

*This survey was conducted online via Fluent’s portfolio of owned and operated media properties. Data was self-reported by 22,944 US adults from March 21 – 24, 2022. Results are specific to the Fluent audience and not reflective of the general US population.